Forex Day Trading

System

Forex Day TradingSystem: After World War II, the Bretton Woods agreement set the exchange rate of all currencies against Gold. In 1971 Richard Nixon ended the direct convertibility of the US dollar to gold resulting in the end of this agreement. Foreign exchange trading now operates as free floating where exchange rates are determined by supply and demand.

Also referred to as Forex or

FX, it is one of the largest and most liquid markets in the world. Estimated to

have a daily turnover of approximately $5 trillion, it dwarfs the stock market and

operates 24 hours a day except for the weekends. Although there is no

centralised exchange for currencies, the main trading locations are London, New

York, Tokyo, Hong Kong and Singapore. Currencies can also be traded on the futures market. See Currency Futures Trading for further information on this approach and the differences between futures and forex.

Electronic trading has made forex markets readily accessible to everyone. Participants include central banks, investment and retail banks, corporations, large financial institutions, fund managers and speculators. Companies make use of forex markets to exchange currencies for the buying and selling of goods but the majority of trading is speculation. Forex day tradingSystemis very popular with proprietary traders, high frequency traders and retail traders all competing to make a profit.

Forex traders try to anticipate that one currency will appreciate or depreciate in value relative to another. Similar to other markets, a forex trade is the exchange of one asset for another. In the stock market, a company’s stock is exchanged for cash. In forex, cash is exchanged for cash but is denominated in different currencies.

Currencies are quoted in pairs. The major pairs are:

Also known as:

EURUSD: Euro v US Dollar Euro Dollar

USDJPY: US Dollar v Japanese Yen Dollar Yen

GBPUSD: British Pound v US Dollar Cable

USDCHF: US Dollar v Swiss Franc Swissie

USDCAD: US Dollar v Canadian Dollar Loonie

AUDUSD: Australian Dollar v US Dollar Aussie

While other pairs are available to trade, these six make up the vast majority of trading volume with the EURUSD being the most popular. Cross currency pairs are pairs that do not involve the USD like the EUR/GBP or EUR/JPY.

Other currency pairs you may see available from an online forex day tradingsystem broker are:

USD/HKD US Dollar v Hong Kong Dollar

USD/SGD US Dollar v Singapore Dollar

USD/ZAR US Dollar v South African Dollar

USD/THB US Dollar v Thailand Baht

USD/MXN US Dollar v Mexican Peso

USD/DKK US Dollar v Danish Krone

USD/SEK US Dollar v Swedish Krona

USD/NOK US Dollar v Norwegian Krone

Currencies are quoted to 4 decimal places with the exception of the Japanese Yen which goes to two decimal places. A pip is the smallest increment of movement in a currency. A move of the EUR/USD from 1.4400 to 1.4401 is a move of one pip.

The first currency is the base currency and is quoted relative to the second currency, the quote or counter currency. The exchange rate is how much of one currency you can buy with another. Effectively you are buying one currency and selling the other. If the EUR/USD is trading at 1.4400 this means you can buy 1.4400 US Dollars for 1 Euro.

Another aspect of forex is that you get paid or charged interest on a daily basis. If the currency you are buying pays a higher interest rate than the currency sold, the difference in interest is paid. If the currency you are buying pays a lower interest rate than the currency sold, interest is charged.

Forex is quoted in two prices, the bid and ask price, with the bid being the lower price. The broker makes money through the spread – the difference between the bid and ask price (also known as the offer price). For example, even though the EUR/USD is trading at 1.4500, the ask (buying) price may be 1.4505 and the bid (selling) price may be 1.4495. This is a spread of 10 pips.

A buyer wants to see the Euro increase in value against the US Dollar. A move from 1.4505 to 1.5000 would be profitable increase 495 pips. A seller wishes to see the Euro decrease in value against the dollar. A move from 1.4495 to 1.4000 would be a profitable decrease of 495 pips.

Of course nobody trades in lots of 1 Euro. Traders typically trade in standard lots of 100,000 units but many online brokers offer mini-lots of 10000 units and micro-lots of 1000 units. A trader does not need €100,000 to trade a standard lot because of the leverage available in forex. This means that the margin required is only a small percentage of the value of the transaction. Often this is as low as 1%.

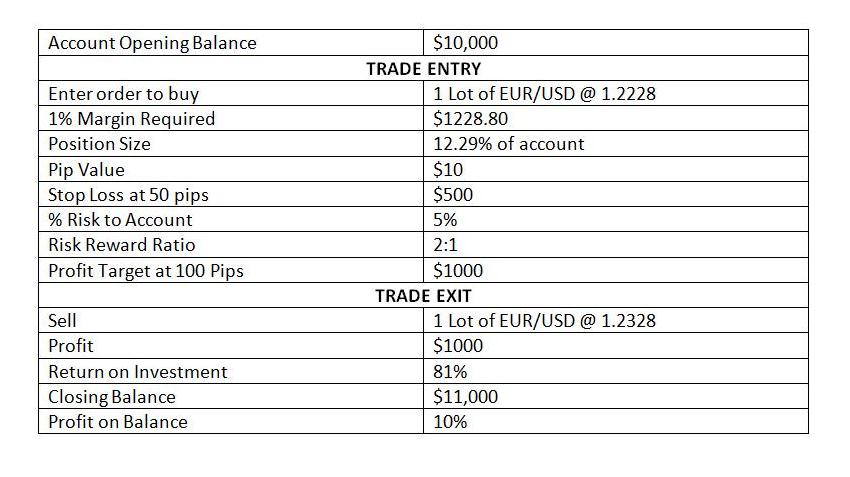

Below is an example of a Forex Trade.

Forex Day Trading System

Forex Day Trading System

Trader has an account of $10,000.

Broker offers leverage of 100:1

EUR/USD is trading at 1.2224/1.2228.

The bid price is 1.2224 and the ask (offer) price is 1.2228.

Trader buys one EUR/USD (Standard Lot) at 1.2228.

Pip value is $10.

Profit Target is 1.2328 or 100 pips.

Stop Loss is 1.2278 or 50 pips.

Transaction value = $122,280 (100,000 * 122228)

Margin Required is 1% of $122,208 or $1228.80

Traders forecast is correct and exits the trade at 1.2328 for a profit of 100 pips.

Profit = £1000 (100 * 10)

Return on Investment = 81% ($1000/1228.80)

Account balance has grown by 10% (1000/10000)

As you can see leverage is a powerful instrument that can magnify profits. Of course it works both ways and can produce large losses as well as profits unless trades are managed well. Many market participants use currency markets for forex day tradingSystemwhile others take a longer term view. Forex traders may use Fundamental Analysis, Technical Analysis Indicators and Chart Patterns or a combination of these to analyse currency markets in an effort to anticipate future movements. Regardless of the approach, it is important to develop a consistent forex day trading system or long term strategy.

Return Top of Forex Day TradingSystem