Trend Lines

Online Currency Trading Strategy

Online Currency Trading Strategy - Trendlines: ‘The trend is your friend’ is an oft quoted saying in trading and investing. Trading with the trend can produce great profits but going against the trend can be a dangerous strategy because trends can develop a powerful momentum. Trendlines, therefore, are an important and frequently used indicator. Trendlines help determine the trend, its velocity, identify areas of support or resistance, inform traders whether to go long or short and identify possible changes in trend.

The market must make a higher bottom in order to draw a trendline. This is done by connecting the first bottom with the second bottom with a line and extending this line out into the future. The trend is validated if the market makes a third bottom, receiving support at the trendline and advancing again. So it t takes two points to join a trendline and the third one validates it.

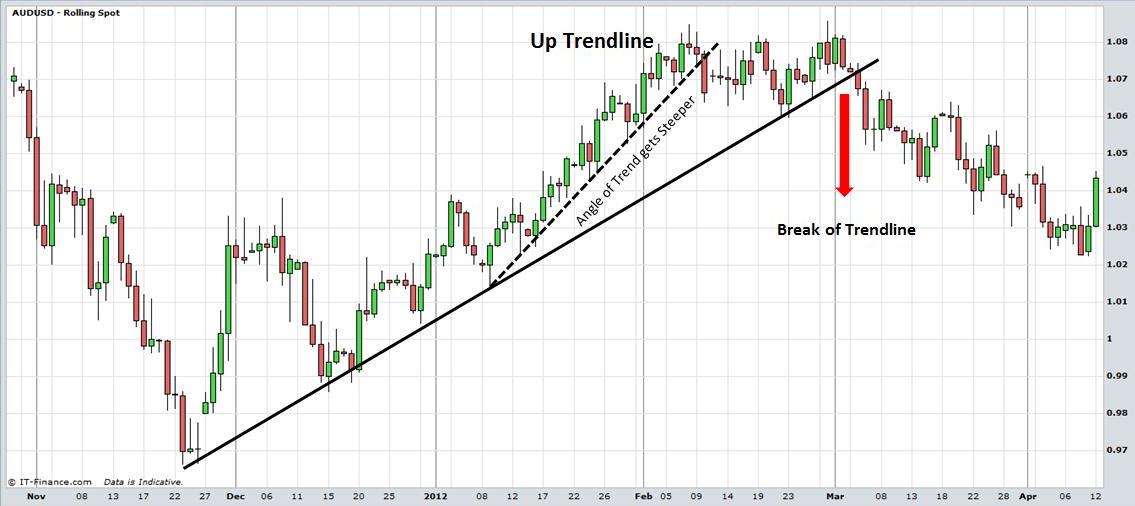

Observe the daily candlestick chart of the AUD/USD currency pair known as the Aussie Dollar. The AUD/USD initially made a bottom on 23rd /25th November, advanced and then declined again to make further lows on 15th/19th December. The market advanced again so the December lows have now formed the first higher bottom. At this stage, we can connect the two lows in November and December with a line and extend it out further into the future.

When the market declines again traders will look to see whether the trendline provides support. The trendline did work because the market declined and on 29th December and 9th January and the market rallied after hitting the line.

Traders adopt different strategies when the market is advancing but the knowledge that a trend has formed is advantageous because it is generally agreed that you should be a buyer during an uptrend. Some traders may buy when the market touches the trendline and place a stop loss X number of points or X% below it.

In early March, prices break below the trendline. This can indicate a change in trend and fall in prices which does occur in this case.

Online Currency Trading Strategy: Trendlines. View chart in interactive mode at ProRealTime.com.

When drawing a trendline or looking for the market to react at it, it is important to allow a reasonable amount of flexibility. Sometimes the market may fall below the trendline on an intra-day price movement but close back on or above the trendline. Markets are volatile by nature so allow for fluctuations around the line without compromising the overall direction.

Another phenomenon that can occur in an uptrend is that the market may begin to advance at a steeper angle. The upward trend remains but it gains velocity advancing at a faster rate. Observe the same chart of the AUD/USD below and see how the market begins to advance at a steeper pace from the 9th January onwards and forms a new trendline. Note that when the market breaks below the steeper trend line, it receives support at the original trendline on 22nd/ 23rd February and for a period of time after that before it breaks down further.

Online Currency Trading Strategy: Trendlines

A down trendline operates in a similar fashion. In order to draw the down trendline the market needs to form an initial top and a lower top. Connect the two tops with a line and extend the line into the future. A third top at the trendline validates it.

Observe in the next chart of the EUR/NZD (Euro/New Zealand Dollar) which formed a trendline between September 2002 and February 2003. Note how the market attempts to break above the trendline in late January but it finds it difficult to close consistently above the trendline and falls back below it again. In early March the market finally does break significantly above the trendline and the trend changes.

Online Currency Trading Strategy: Trendlines

Trendlines can be an important tool from a trader’s or long term investor’s point of view because they can be applied to any time frame, whether it is an intraday, daily, weekly, monthly or even annual chart. Not all indicators are used by all traders but you can be sure that all traders want to know the trend.

Trendlines can be used in trading Stocks, Exchange Traded Funds, Forex, Commodities, Bonds, Futures, etc. Traders should always implement appropriate risk management and stop loss strategies.

Return to Top of Online Currency Trading Strategy: Trendlines