Online Investment

Portfolio Investing

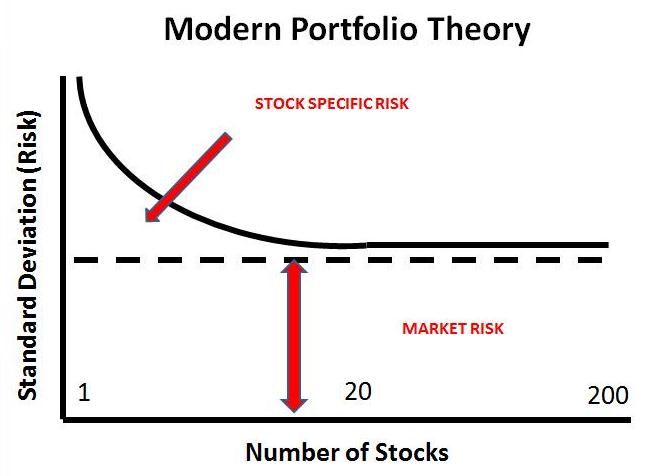

Online Investment – Portfolios: The main purpose of portfolio investing is diversification. If 100% of your capital is invested in one stock or one asset it’s a high risk strategy. An individual company or asset can suffer dramatic falls which in value would destroy your capital. By diversifying we can avoid such an outcome and still gain exposure to decent returns. However, some types of risk are difficult to avoid. Systematic or market risk affects all markets or a whole market sector. A global downturn, for example, will cause all equity markets to fall. Unsystematic risk applies to specific investments such as one company or sector. Unsystematic risk can be reduced through diversification and building an investment portfolio. At the end of the day no one can be really sure which stock or asset class is going to be the star performer in future years. By investing across assets, you can gain exposure to them all. The return might not be as great as if you picked the best performer but it’s certainly a safer bet.

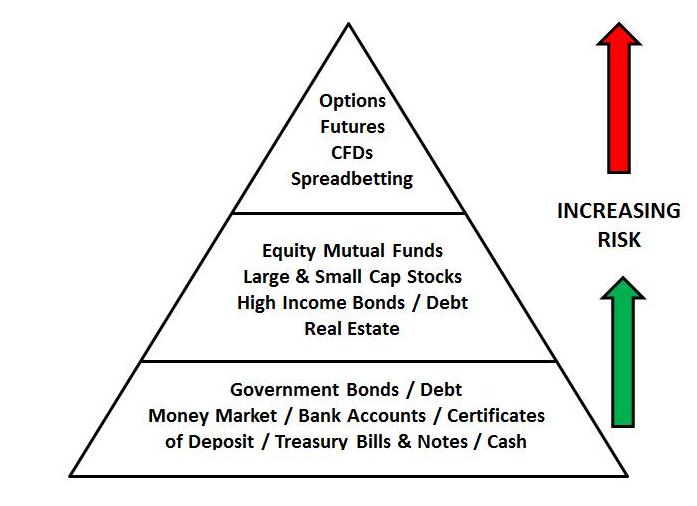

The composition of a portfolio depends on the aggressiveness of the investment strategy. An aggressive portfolio will have a heavier component of riskier assets. Stocks are generally regarded as a risker asset than bonds. You may have heard the saying that you should ‘subtract your age from 100’ to decide how what percentage of your investment capital should be invested in stocks. That’s a pretty rough and unscientific approach to investing. What about all the other investment classes such as commodities, real estate, money markets, precious metals, etc. However, it does highlight the principal of diversification and risk allocation.

The diagram below is a general guide to the level of risk of each type of asset class. In real life it’s not as neat a classification as this but it demonstrates the point.

Online Investment: Portfolio Diversification

Not only can diversification be achieved by investing in different asset classes but also within asset classes. For example, an investor may decide to invest 35% of their capital in stocks, 50% in fixed income, 10% in cash and 5% in precious metals. To attain greater diversification an investor should, for example, choose a number of stocks from different industry sectors. Now, not only are they diversified across assets but the equity part of the portfolio is also diversified. The question arises, then, as to how many stocks to invest in?

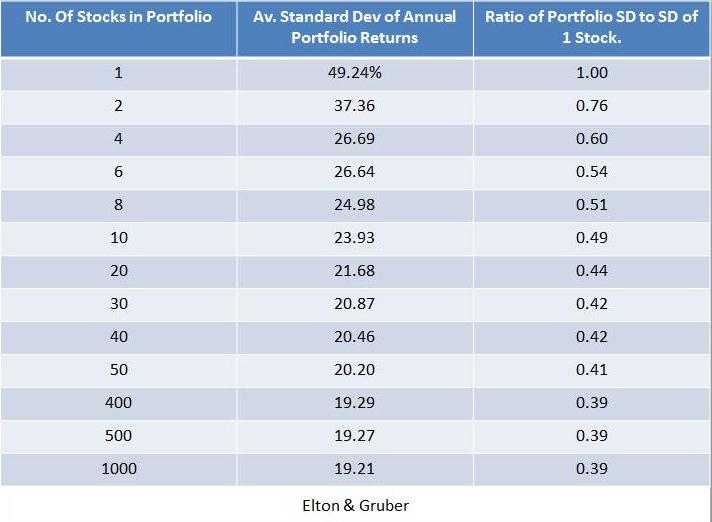

In 1977 Elton and Gruber performed a study of the gains from diversification. The results were very interesting. The average standard deviation of annual returns from holding one stock was over 49%. That’s a huge amount of volatility. Each time a new stock is added to the portfolio the volatility decreases. The most interesting part of the study was that by the time 20 stocks are in the portfolio, little more protection is gained by adding more stocks. An investor is inclined to believe that the more stocks they own the more they are diversified and protected from risk. This study, however, proved otherwise. In fact, the table shows there isn’t much of a difference between owning 10 stocks and 20 stocks. See the table and chart below for further detail.

Online Investment: Portfolio Diversification

Online Investment: Portfolio Diversification

An investor could choose to buy 10 or 20 individual stocks. Alternatively they could invest in a mutual fund which is actively managed and invests in a portfolio of assets. Exchange Traded Funds (ETFs) are also an attractive option. ETFs are similar to mutual funds but can be bought and sold on a daily basis just like shares. They offer the diversification of managed funds but are far more cost effective. Numerous ETFs exist that allow investors to buy into a basket of stocks, commodities or other assets that make up an index or sector. Go to the Exchange Traded Funds page for a more detailed explanation.

In conclusion, portfolio investment is a wise strategy for the long term investor. Nobody can guarantee the returns of an individual asset which is why diversification is so important. Exposure across a range of investments offers the opportunity to participate in the assets that do perform. The rate of growth may be tempered by the assets that underperform but that is a sacrifice worth making for investors who wish to minimize risk.

Click on the following links for information on other asset classes: Stocks, Exchange Traded Funds, Currency Futures / Forex, Commodities, Bonds, Futures, Options.

Return to Top of Online Investment - Portfolio Diversification

Return to ForexFundamental Analysis